Latest News on Your Doctor's Blog

Loading…

Dental Insurance Many of our patients use dental benefit plans to help cover the cost of their dental treatment, so we would like to explain why your insurance may not cover the entire cost of your dental procedure, or why it covers some dental procedures and not others. Dental Insurance is a Contract Most dental benefit plans are the result of a contract between an insurance company and your employer, union, or association. The person who negotiates the terms of your insurance plan makes the final decision on maximum levels of reimbursement through a contract with the insurance company. Your Insurance Plan Your insurance plan may want you to choose your dental care from a list of their preferred providers. Choosing your dental care provider from this defined group can affect your levels of reimbursement. Our office is not on these lists so many times you are covered at a reduced rate. Your plan may also tell you that they will only pay benefits for the least expensive alternative treatment for a condition, or deny coverage for conditions that existed before you enrolled in the plan. A deductible is the amount of dental expense for you are responsible for before your […]

Insurance FAQ What insurance does your office accept? We are a Delta Dental Premier Provider. We accept and honor other PPO plans, however we are out of network which means that your insurance is accepted at a lower benefit as determined by your insurance company. We do not accept HMO plans, however we would be glad to help guide you during open enrollment to find a plan Dr. Poore accepts. If you do not have insurance we can still see you as a private patient. What is the difference between PPO, HMO, and Indemnity Insurance Plans? PPO (Preferred Provider Organization) is the most common form of insurance. They provide members with a list of participating dentists to choose from. The dentists on this list have agreed to a lower fee schedule, which provides you with greater savings. They also assist with insurance billing. Most companies pay 50% on major treatment (crowns, bridges, partials), 80% for basic care (fillings), and up to 100% for preventative care (exams, x-rays, basic cleanings). Annual maximums generally range from $1,000 to $2,000. HMO, also known as capitated or prepaid insurance, was designed to provide members with basic care at the lowest rate. Participating providers receive […]

Payment: Payment is expected at time of treatment. If you have insurance, you will be expected to make an estimated payment for any portion not covered by your insurance plan. We offer several payment options: Insurance: Dental insurance is intended to cover some, but not all of the cost of your dental care. Most plans include coinsurance provisions, a deductible, and certain other expenses which must be paid by the patient when service is rendered. It is your responsibility to verify insurance coverage and assume responsibility for payment of all procedures you elect to have done. Your dental insurance is a contract between you and the insurance carrier and not between the insurance carrier and the doctor. Therefore you are responsible for all dental fees. We are a Delta Dental Premier Provider. We accept and honor other PPO plans, however we are out of network. This means that your insurance benefits will be reduced as determined by your insurance company. We do not accept any HMO plans. If you have any questions about your insurance plan or payment options, please call our staff a (909) 484-4888.

We understand that plans can change and emergencies can pop up. In order to be respectful of other patients, if you are unable to keep your appointment, we ask that you provide us with at least 24 hours notice. We ask for this advanced notice so that we can offer your appointment time to another patient who is in urgent need of treatment. To cancel or reschedule your appointment, please call us at (909) 484-4888 a minimum of 24 hours in advance. The office is open Monday and Tuesday from 2:30 p.m. to 8:00 p.m., Wednesdays 8:00 a.m. to 2:00 p.m., and Fridays 8:00 a.m. to 2:00 p.m. You can also cancel your appointment by leaving a message on the answering machine at least 24 hours in advance.

If you have oral surgery in our office, here are the post operative care instructions to help you feel better faster. Bleeding: Light to moderate periodic bleeding is expected following oral surgery. If bleeding is persistent, place a pre-moistened gauze or dampened tea bag over the bleeding point and apply pressure by biting or pressing with finger tip. Continue firm pressure for 30 minutes before removing pad and resume if bleeding continues. Do not spit or rinse the first day of surgery. Pain: Take one or two tylenol every four hours. If you have been supplied a prescription for pain take as directed. Aspirin is not advised because it is a blood thinner and may cause increased bleeding from the surgical site. Swelling: Peak swelling is expected 48-60 hours following surgery. Ice applied to the sides of the face is of some help, but do not leave ice bag in contact with skin for longer than twenty minutes out of every forty. After four hours, use ice only if it makes you feel better. Do not apply moist heat unless previously directed. Diet: The sooner you can eat normally again, the better. Try a nutritious liquid diet at first and […]

We are committed to being in the forefront of technological advances are are very pleased to inform you that we use digital x-rays in our office. Some of the very significant benefits are: Periodic radiographs are an essential part of complete diagnosis and prophylaxis, and this advanced technology makes them better and quicker.

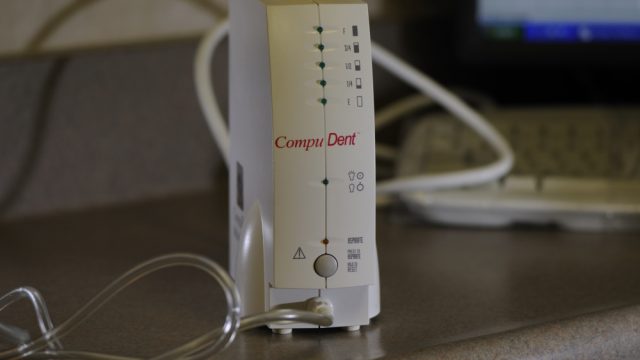

We know that one of our patients concerns about going to the dentist is the pain often associated with it. Dr. Poore uses the CompuDent Wand system for local anesthesia which helps to remove the pain from dental injections. CompuDent is a computer controlled means of delivering local anesthesia. It maintains a steady flow of anesthesia which drastically decreases any discomfort. The needle at the end of the wand is much smaller than a conventional syringe. In fact, this system doesn’t even look like a needle. It looks more like a small computer tower with a ball point pen attached. CompuDent Wand is different than the traditional hand syringe. A traditional syringe delivers a low volume of anesthesia at a high pressure which can cause pain. The wand delivers a larger volume of anesthesia at a lower pressure which means a more comfortable injection. Researchers have found that the CompuDent Wand system induces less anxiety than any other injection method because it doesn’t look like a conventional syringe (Kudo et al, 2001). With the CompuDent Wand system Dr. Poore is more efficient and more accurate which means a better dental experience for our patients.

A letter to all patients about the link between good oral hygiene and overall health. Dear Patients: I once saw a patient who left a dental infection untreated which resulted in life-threatening infections of his heart and intestines that required several surgeries and a lengthy hospital stay. He asked me to inform my patients of this event and how committed he now is about receiving regular dental care. We all need to see the dental hygienist on a regular basis. These visits can help prevent the kind of serious systemic problems caused by poor dental health. After two decades of research, it has been firmly established that an association exists between periodontal [gum] disease and cardiovascular disease. Journal of the American Dental Association, Vol. 137, October 2006 In recent years, evidence has come forth supporting the notion that localized infectious diseases such as periodontal [gum] disease may indeed influence a number of systemic diseases. This view holds that bacteria from dental plaque enter the blood stream through …the oral tissues and travel through the blood to cause infection at a distant site…. A number of studies suggest that periodontal disease is associated with diseases resulting from atherosclerosis, lung disease such […]

In the video, your dental hygienist, Christine Birchfield, RDH discusses the link between your oral health and systemic diseases. Regular Prophylaxis (dental cleanings) can help prevent cavities, gum disease, and tooth loss caused by dental disease. Regular cleanings can prevent the need for more costly dental treatment like fillings or crowns. During a cleaning the Hygienist will remove plaque and tarter before they go below the gum line and cause and infection. Proper oral hygiene care can help prevent serious systemic diseases, i.e. diseases in other parts of your body. Visiting the dental hygienist on a regular basis can help prevent the kind of serious systemic problems caused by poor dental health. It is important to maintain your routine dental care visits and improve upon your own daily oral hygiene to help protect your overall health. So please be sure to see your dentist, Dr. Danny Poore, and your Dental Hygienist, Christine, on a regular basis.

Temporomandibular Disorders (TMD) Have you ever felt a painful clicking or popping in your jaw when you talk, chew, or just open your mouth? Many people suffer from a jaw, muscle, and joint disorder known as temporomandibular disorder (TMD) and may not even know it. While it is not always possible to pinpoint the exact cause of TMD, in many cases it is due to arthritis, injury, tooth grinding, or stress. TMD can cause severe pain and discomfort. Common symptoms of TMD include: Pain or tenderness in or around the ear, jaw joint, or around the face Tender jaw muscles A tired feeling in the face Clicking or popping noises in the jaw Difficulty opening or closing your mouth Jaw joints that feel as if they are “locked” or “stuck” Pain when you yawn, chew, or open your mouth wide Headaches or earaches As your dentist, I want you to know that there are ways to treat this condition based on your specific diagnosis. Treatment could include modifying the pain through relaxation techniques or wearing a custom made night guard to prevent the teeth from touching while you sleep. If you have been experiencing any of these symptoms of TMD, please […]

Your body responds to stress in many ways. Your oral health can even be affected by stress. Here are some ways stress and your oral health are related: The habit of grinding or clenching your teeth, typically while sleeping is called dental bruxism which may be caused by stress. Symptoms of bruxism include headaches, a sore jaw, frequent toothaches, and damage to teeth or dental work. Periodontal (gum) disease might be linked to high stress. Signs of gum disease include bleeding gums when you brush or floss; red, swollen or tender gums; and gums that have pulled away from your teeth. Canker sores may also be stress-related. These small sores appear on the soft tissues inside your mouth or on the base of your gums. Most canker sores go away in a week or so. If you have a sore that takes longer than two weeks to heal, please call the office for an exam with Dr. Poore. Another way your body responds to stress is through unhealthy eating habits which ultimately affect your oral health. If you do find yourself reaching for sugary snacks throughout the day you are contributing to the plaque in your mouth. If you find yourself feeling stressed, try […]

Dental Bruxism Do you ever wake up with dull headaches, vise-like pain, or stiff and/or sore jaw muscles? If so, you could have a habit of grinding or clenching your teeth called bruxism. Many people are unaware they are grinding their because it frequently happens while they are asleep. However, dental professionals, like Dr. Poore and the hygienists, can usually detect signs of wear on your teeth caused by bruxism. Bruxism can be caused by stress, sleep disorders, an abnormal bit, or crooked or missing teeth. Grinding your teeth can result in pain, fracturing, loosening of teeth, or tooth loss. Patients can actually grind away parts of their teeth, leaving them with worn surfaces or fractured enamel. Bruxism can not only wear down your teeth and damage dental work, but can also cause aching muscles and headaches. Fortunately, treatment for bruxism and any damaged teeth is available. Options include reducing stress, exercises to relax jaw muscles, using a custom made night guard while sleeping, and getting fillings or other dental treatment to fix the damaged teeth. If you suspect you are grinding or clenching your teeth, schedule an appointment to talk to us about your symptoms and possible treatment plans at (909) 484-4888 or email [email protected].

New research has strengthened our understanding of the link between heart disease and periodontitis (gum disease). Visiting the dentist and dental hygienist regularly can help prevent serious systemic problems caused by poor dental health. Click here to learn more about the importance of good dental care. Periodontitis and heart disease share a common pathogen, P. ginivalis. A recent study found that P. ginivalis alters gene expression which increases inflammation and plaque buildup in the arteries of the heart. This triggers and hastens coronary heart disease. Below is a more detailed exploration of this new research and is a reminder to see your hygienist regularly to not only protect your teeth and gums, but also your heart and overall systemic health. The study, published in Microbiological Research, has clarified the mechanism behind a known link between gum disease and heart disease. Periodontitis, which results in an infection that damages the soft-tissue surrounding teeth and the bone supporting the teeth, is commonly caused by P. gingivalis. After an initial infection, P. gingivalis continues to colonize tissues of the mouth for long periods of time. The same bacterium, P. gingivalis is commonly found within the arterial plaques common to heart disease patients. The authors […]

There have been quite a few changes happening at our dental office in the past few weeks. After 38 years of dedicated service, Evelyn, our beloved office manager has retired! Evelyn plans to spend her retirement with her children, grandchildren, and great grandchildren. She also plans on spending more time gardening, sewing, and traveling. We congratulate Evelyn on this milestone and hope that she enjoys her well-earned leisure time. If you would like to send your well wishes and congratulations, you can send it to our office and we will be sure to forward it. We know that Evelyn is one of your favorite faces to see and it won’t be the same without her. While we will truly miss Evelyn, we are very lucky to have Beth and Katie to fill her shoes and keep the office running smoothly. Beth has been working at the office for seventeen and a half years as the assistant office manager. Katie has been with us for the last ten years. They both look forward to helping serve the dental needs of you and your family. The whole staff looks forward to seeing you soon and providing you with the best in dental […]

As most of you know, your oral health is linked to your overall health. A new study by the American Association for Cancer Research found that periodontal disease, an infection of the gum and bone that hold teeth in place, “was associated with increased risk of postmenopausal breast cancer.” The study, Periodontal Disease and Breast Cancer: Prospective Cohort Study of Postmenopausal Women, found that women with periodontal disease were at a greater risk of developing breast cancer. According to the researchers, the risk of breast cancer is 14% higher in women with periodontal disease. One possible reason for this increased risk is that the bacteria from the mouth can enter the body’s blood stream and affect the breast tissues. Additionally, microbes typically found in the mouth, are also present in breast tissues. Further studies are needed to fully understand the relationship between periodontal disease and breast cancer. This study reminds us of the importance of seeing your dental hygienist regularly. Let these health professionals help protect your overall systemic health by keeping your gums and teeth healthy. Please consider how consistent home dental care and regular dental visits can assist in your overall health.

As many of you know, there is a need for regular dental care. A new study highlights the need for preventive dental care as it relates to dental fillings and restorations – that is the more care, the less need for dental treatment. For more information on this study, the journal article can be found here. The study, published in Community Dentistry and Oral Epidemiology in December 2015, found that the need for dental restorations can be reduced by 30% to 47% through preventive oral care treatment. This is in addition to the relationship to systemic (overall) health and dental health, as some of you might remember from previous letters from this office. I encourage everyone to maintain their dental and systemic health by seeing their hygienist regularly, limiting their sugar intake between meals, and maintaining a good daily home care routine. Danny D. Poore, D.D.S. USC School of Dentistry 1974